Case Study: Techcombank Auto-Earning #20

Techcombank's Auto-Earning is a unique feature that Techcombank offers to customers. Let's explore its success and recommend potential enhancements.

Background

Techcombank, a leading bank in Vietnam, launched its Auto-Earning feature in January 2024. This feature allows customers to earn interest on their idle cash balances in primary accounts at a competitive rate of 2.5%/year, enhancing customer satisfaction and increasing CASA ratio.

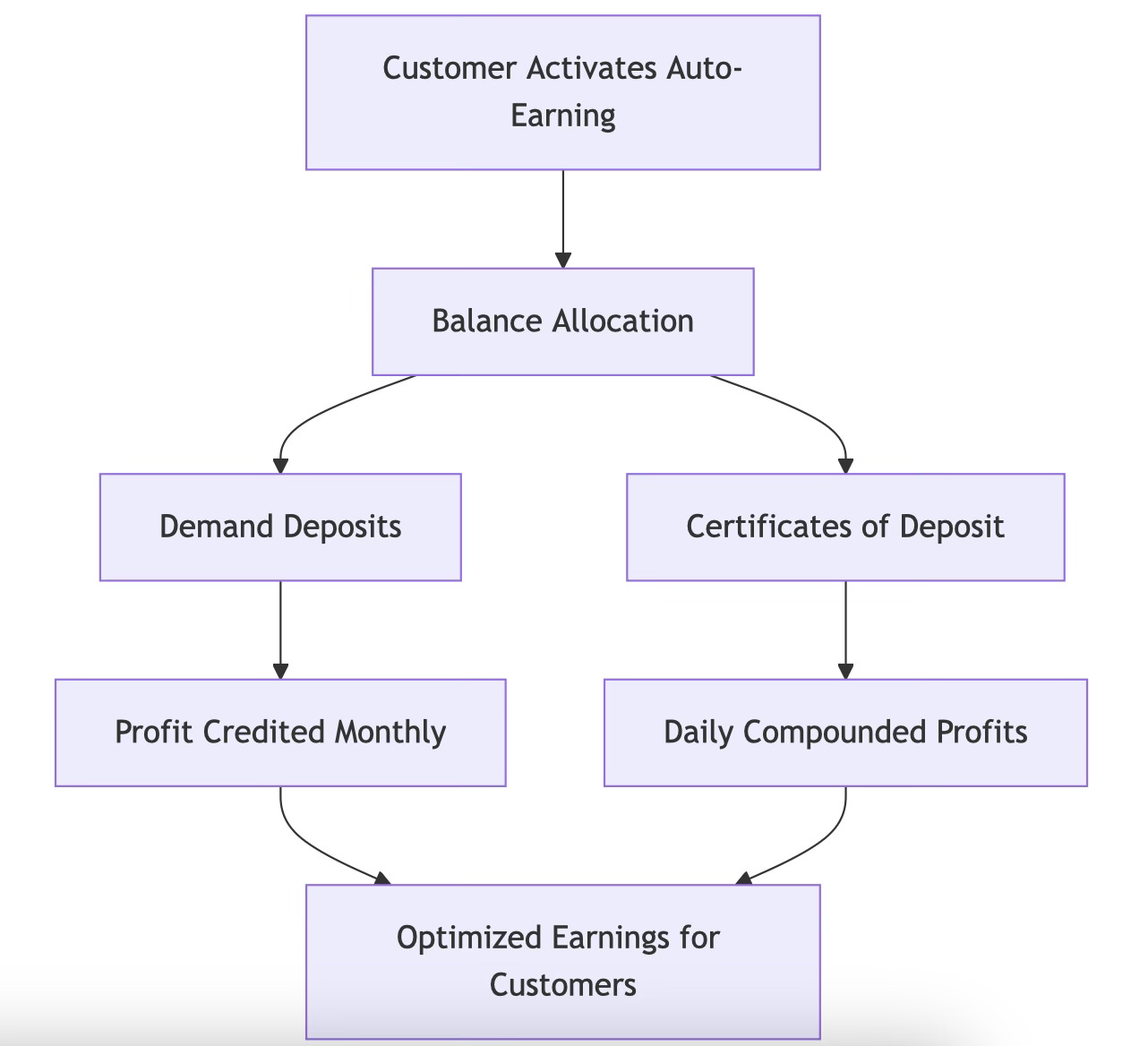

How It Works

Activation: Customers activate Auto-Earning on the Techcombank Mobile app.

Fund Allocation: The account balance is automatically divided into:

Demand Deposits for immediate access.

Interest-Bearing Products like Bao Loc Certificates of Deposit for higher yields.

Daily Profit Calculation: Profits are calculated daily based on the account balance at the end of the day. The higher the balance, the higher the yield.

Profit Distribution:

Demand Deposits: Profits credited monthly.

Certificate Deposits: Profits reinvested daily into the balance for compounding growth.

Goal

This case study examines the Auto-Earning feature to identify gaps and propose solutions for improvement.

Product Overview

Business Highlights

Customer Growth: 13.4+ million customers (as of December 31, 2023), 2.3x growth from 2022 with 2.6 million new adopters.

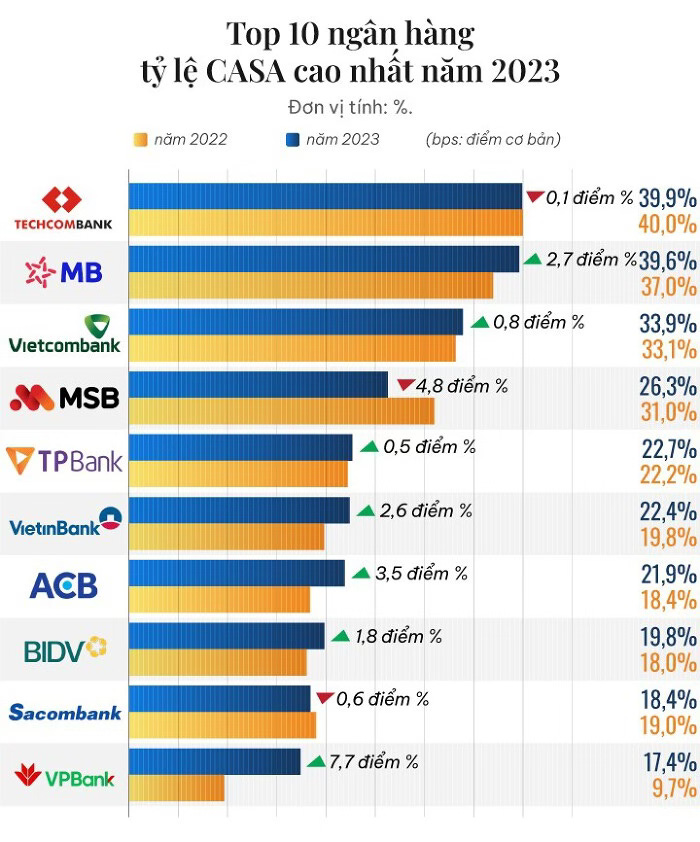

Strong CASA Ratio: CASA ratio of 39.9% (2023), ranked Top 2 in Vietnam.

Robust Financial Performance:

Total Operating Income: VND 40,061 billion in 2023.

Profit Before Tax: VND 22,888 billion in 2023.

Market Leadership: Ranked Top 1 in credit and debit card payment volume in Vietnam (2023).

Source: Techcombank.

Auto-Earning Stats

1.3M+ Activated Users (9K+ Daily) from Q1-Q3 2024.

VND 19,500B+ Account Balance (35% growth) during Q1-Q3 2024.

Source: Techcombank.

Market Landscape

Market Size & Growth

The Digital Banks market in Vietnam is projected to grow by 7.46% (2025-2029), resulting in a market volume of US$1.56 billion in 2029.

Source: Statista

The Digital Payments market in Vietnam is projected to grow by 18.94% (2025-2029), resulting in a market volume of US$203.10 billion in 2029.

Source: Statista

Techcombank and MB Bank are the highest Casa ratios in Vietnam in 2022 and 2023.

Source: Vietnambiz

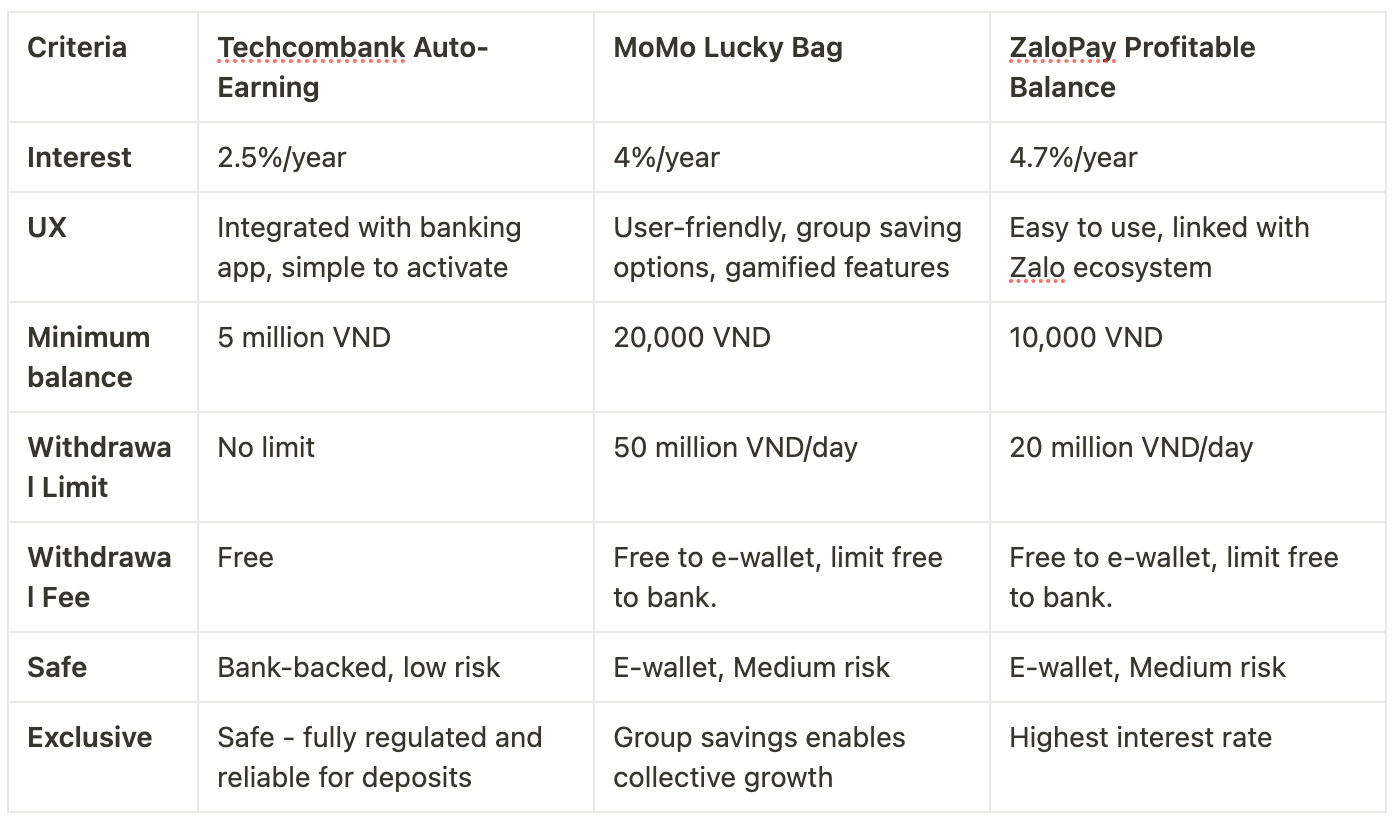

Direct Competitors

Personas

Persona 1: Nguyen Anh Tuan

Demographics:

Age: 28

Sex: male

Occupation: Product Owner

Location: Tam Ky, Quang Nam, Vietnam

Bio: Tuan is a tech-savvy worker who uses digital banking apps to manage his finances. He activated Auto-Earning to grow his savings but finds some aspects unclear.

Goals:

To earn more from his idle money.

To easily track daily updates on his interest earnings.

Frustrations:

Lack of Transparency: He finds it hard to track how much interest he earns daily.

Worries About Security: He’s unsure how Techcombank ensures the safety of his money.

Quote: “I want to know exactly how much I’m earning every day, but I feel unsure about my account.”

Persona 2: Tran Hoang Anh

Demographics:

Age: 20

Sex: male

Occupation: University Student

Location: Tam Ky, Quang Nam, Vietnam

Bio: Hoang Anh is a student managing a tight budget. He’s interested in saving money but feels excluded from Auto-Earning due to the minimum balance requirement.

Goals:

To save and grow his small savings.

To access Auto-Earning with a lower minimum balance.

Frustrations:

The current 5 million VND minimum balance makes Auto-Earning inaccessible for him.

Quote: “As a student, I wish the feature worked for smaller balances too.”

Persona 3: Le Thi Mai

Demographics:

Age: 35

Sex: female

Occupation: Freelance Writer

Location: Tam Ky, Quang Nam, Vietnam

Bio: Mai has an irregular income and relies on banking features to help manage her money. She’s cautious about where she places her savings.

Goals:

To grow her savings safely.

To feel confident that her money is secure.

Frustrations:

Mai is worried about how her savings are protected within Auto-Earning.

Quote: “I want to use this feature, but I need to know how my money is kept safe.”

Persona 4: Vu Quoc Bao

Demographics:

Age: 29

Sex: male

Occupation: Software Engineer

Location: Tam Ky, Quang Nam, Vietnam

Bio: Bao is a tech enthusiast who loves trying out innovative banking features. However, he often finds banking processes confusing and time-consuming.

Goals:

To easily understand how Auto-Earning works.

To make the most out of his idle money.

Frustrations:

Bao struggles to understand how Auto-Earning allocates his funds and generates profits.

Quote: “It shouldn’t take so long to understand how this feature works.”

Persona 5: Pham Hong Lan

Demographics:

Age: 32

Sex: female

Occupation: Stay-at-home Mom

Location: Tam Ky, Quang Nam, Vietnam

Bio: Lan manages her family’s budget and wants her savings to grow without adding extra work.

Goals:

To track her earnings without hassle.

To feel reassured about her savings’ performance.

Frustrations:

Lan finds it frustrating that she can’t see clear, real-time updates on her earnings.

Quote: “I want an easy way to track my savings without worrying if it’s growing.”

Problem Statement

Techcombank Auto-Earning struggles with user adoption due to unclear daily earnings tracking, high activation thresholds, security concerns, and a lack of simple explanations on how the feature works.

Key pain points

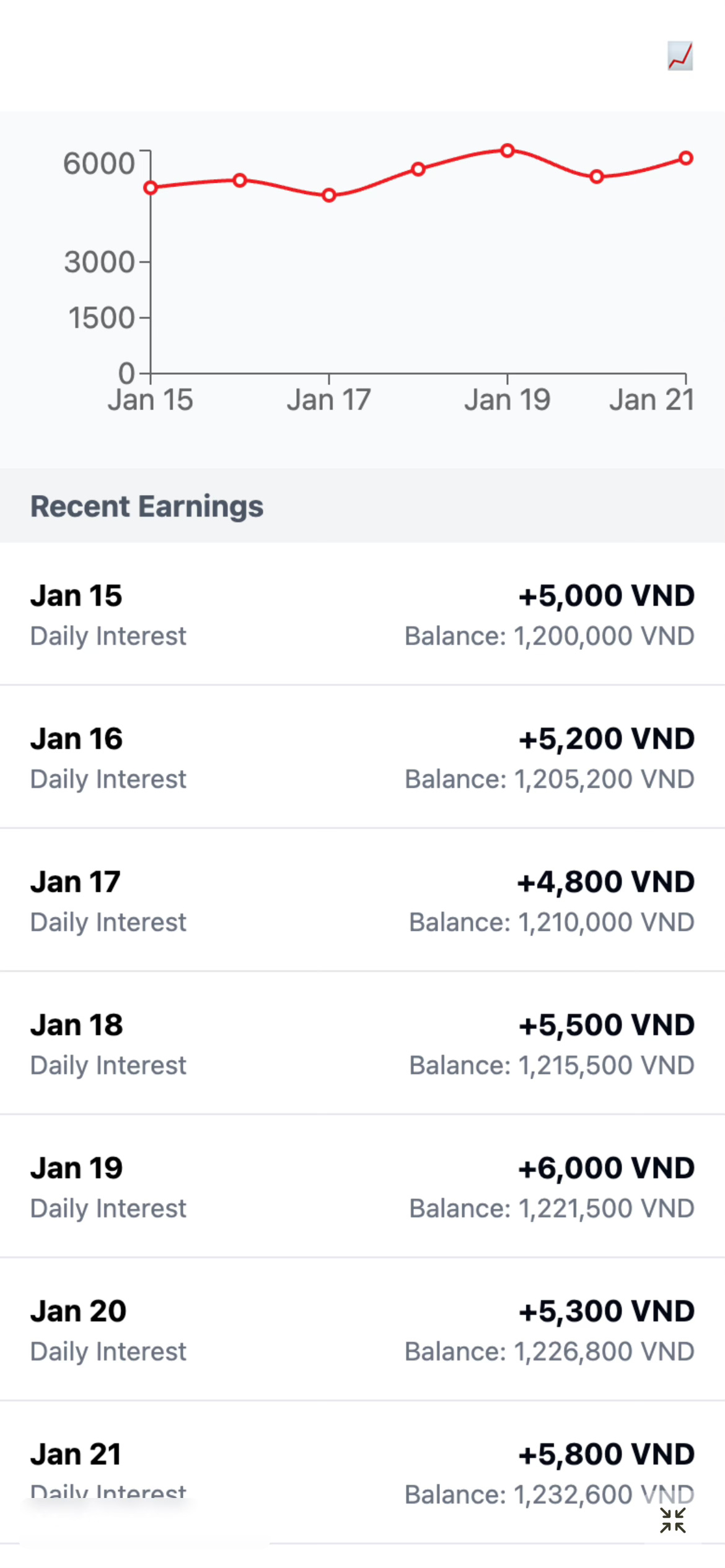

Transparency: Users can’t easily track daily interest or see transaction details.

Accessibility: High minimum balance (5M VND) excludes low-income users like students.

Security: Users worry about how their funds are protected.

Complexity: Misunderstanding of how the feature works discourages use.

User Confidence: Some users fear losing access to funds or missing key features.

Recommend Solutions

Solution 1: Auto-Earning Daily Histories

Feature Overview

Provide a detailed transaction history of daily earnings. Users can easily view how much interest their balance has generated each day through their banking app.

Value for Customer

Improves transparency and builds trust by clearly showing daily earnings and interest rates.

Outcomes

Increased user satisfaction and retention.

Fosters trust and reduces confusion about earnings.

Challenges

Requires robust system tracking and real-time reporting features.

Solution 2: Multiple Tiers for Minimum Balance

Feature Overview

Introduce flexible tiers for activating the Auto-Earning feature. Allow customers, such as students or low-income individuals, to activate the feature with smaller balances (e.g., 1M VND, 2M VND) instead of the current 5M VND threshold.

Value for Customer

Makes the feature accessible to a broader audience, including those with lower income or savings, increasing customer satisfaction and inclusivity.

Outcomes

Increased user satisfaction and retention.

Fosters trust and reduces confusion about earnings.

Challenges

Requires robust system tracking and real-time reporting features.

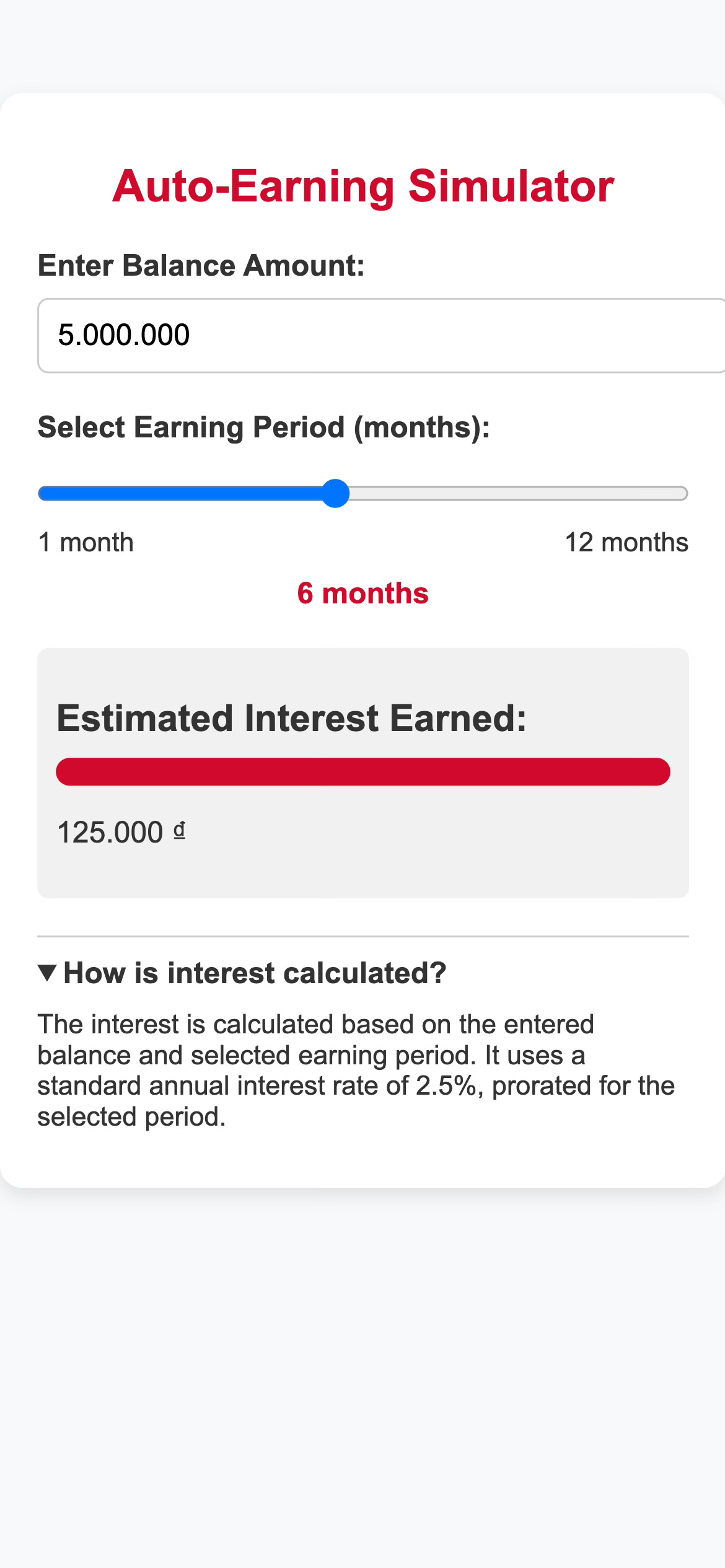

Solution 3: Simulate How Money Is Allocated and Earned

Feature Overview

Offer an interactive simulator in the app to show how users’ funds are allocated and how much they can earn over specific timeframes.

Value for Customer

Enhances understanding of how Auto-Earning works and provides clarity on the feature’s benefits.

Outcomes

Reduces misunderstandings.

Builds confidence in using the feature.

Challenges

Requires a user-friendly design and system calculations to offer real-time accuracy.

Prioritized Solutions

RICE Score = (Reach * Impact * Confidence) / Effort

Reach: Percentage of user growth compared to the current number of users in the first quarter.

Impact: Percentage of growth in the auto-earning amount compared to the current value in the first quarter.

Confidence: Your certainty of success, expressed as a percentage.

Effort: Time required to implement the feature (in months).

Multiple Tiers for Minimum Balance has the highest RICE score and should be prioritized first.

Success Metrics

Go-to-market Strategy

Thanks for being here! What do you want to see next?

What a structural analysis! ✅

Cho lần thứ 2 đọc, em thấy nó đủ sâu để kể 1 câu chuyện, có số liệu, có dẫn chứng nhưng lại không hề khó hiểu theo kiểu học thuật. Cám ơn anh